How to get started with NFTs and DEFI on Solana Blockchain

Learn about Solana NFTs and Decentralized Finance (DeFi). You maybe have done some of your own research, and then found out that the original place that NFTs were basically launched, the Ethereum Blockchain (ETH), is crazy expensive right now to do any transactions on due to high gas fees.

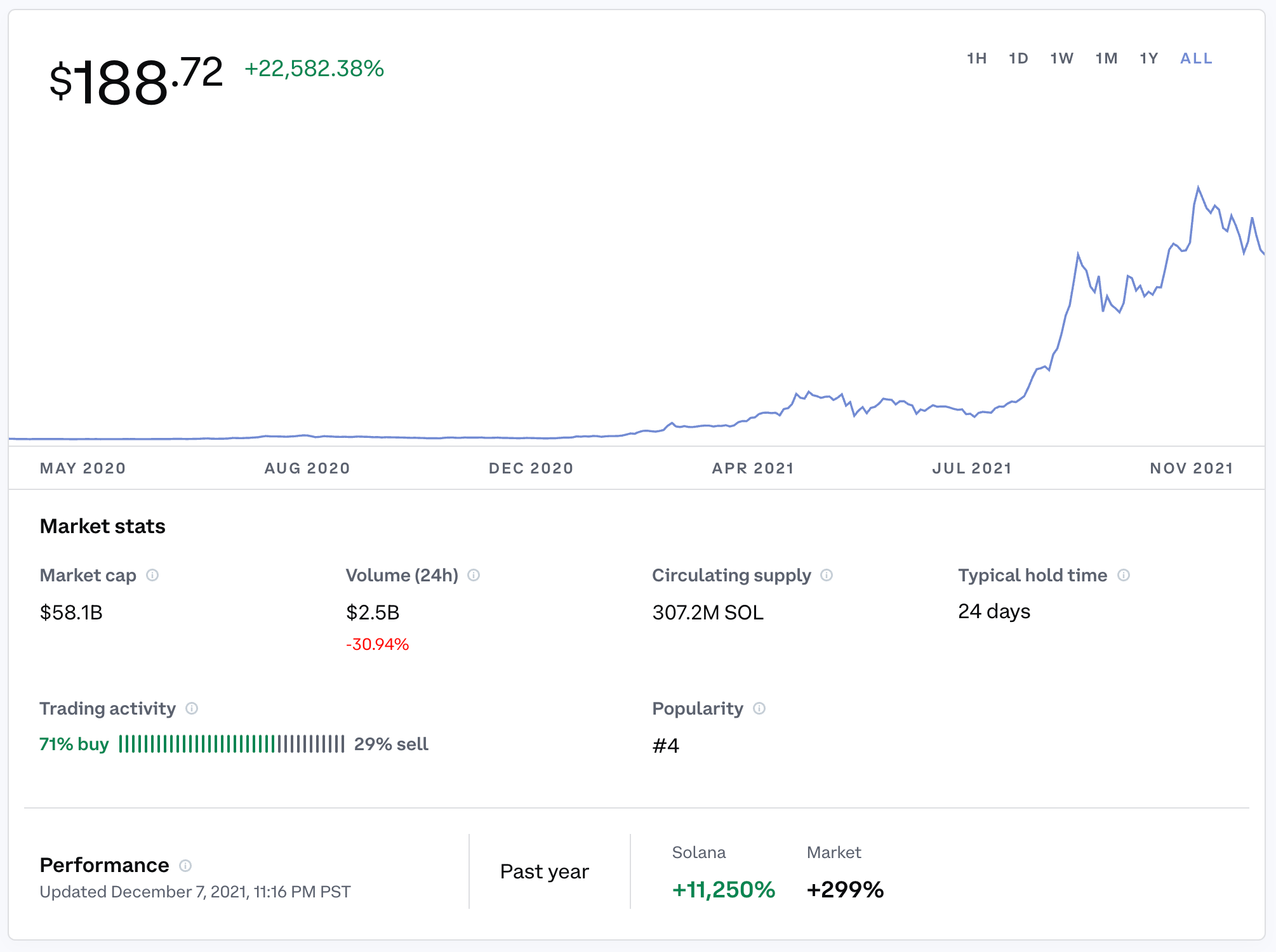

Enter the Solana blockchain. This is the rapidly growing, #3 blockchain after Bitcoin and Ethereum.

NOTE that none of this information should be construed as Financial Advice, it is all based on my personal experience, but proceed with care, because there are some potential risks involved.

Benefits of Solana:

- Extremely low cost of transactions on the network (less than a penny most of the times)

- Very very fast. Transactions clear in seconds typically, not minutes.

- Very dynamic ecosystem. Decentralized Finance (DeFi), NFTs, DAPPs, developers are loving Solana.

(SOME OF THE Many) RISKS of getting into this stuff:

- Crypto prices are highly volatile. 5-10-20-30% swings in ONE DAY are common. This is a total roller coaster, and when things are going up up up you might feel like a genius. And when they go down down down you may feel like crying.

- It is a very speculative space right now. Very early still. Lots and lots of experimentation happening, lots of money being invested, and lots of people getting on board… which leads to…

- SCAMMERS, HACKERS, and generally UNETHICAL people are happily operating in this (largely) unregulated space. Even well-intentioned people are setting up projects, promoting them, pumping them, and then find that (for whatever reason), they can’t deliver on their promises.

Know for yourself if this is the type of game you enjoy playing. Do Your Own Research (DYOR). Be careful. Don’t put more into this than you can afford to lose in case something goes sideways.

With all of that being said, if you would like to dip your toe into acquiring NFTs or exploring Decentralized Finance (DeFi) on the Solana blockchain, this guide is for you! It is written assuming that you are not already familiar with the crypto ecosystem.

IF THIS IS NOT FOR YOU, DON’T DO ANY OF THIS STUFF, BAIL NOW. OBVIOUSLY.

Step 1: Get an account where you can purchase some crypto.

Set up an account at a centralized exchange. In the U.S. the most popular exchanges are Coinbase and FTX.us. Here are signup links in case you don’t already have an account (affiliate links, you’ll get a reward if you join & so will I):

Sign up on Coinbase – Get $10 in Bitcoin when you buy or sell $100 or more in crypto

Sign up on FTX.us – Get 5% discount on trading fees (and they’re already lower than Coinbase)

You’ll need to complete Know Your Customer (KYC) verification with any of these centralized exchanges (basically confirming your identity), which may take a little while, and then you can fund your crypto account by either connecting a bank account or your credit card.

How much to buy initially? Up to you, but make it an amount that isn’t too big of a hit if it loses 50% of its value. (It also could rise 50% or more, which is what makes crypto so exciting. Or terrible.)

What to buy? Bitcoin is the most popular / highly traded cryptocurrency. Not a bad idea to buy some and hold it. Ethereum (ETH) is also very popular, and many folks are invested in that ecosystem. Personally, I’m sold on the Solana ecosystem, and their crypto coin is SOL. This is needed in order to do any transactions on the Solana network, so it is what I suggest purchasing if you’d like to participate on the Solana network. All cryptocurrencies can be purchased in fractions, so you don’t need to purchase a whole Bitcoin or ETH or SOL. No problem at all to purchase a fraction of one of those, again, depending on your comfort level.

Explore crypto coin prices, market caps, popularity, and more: https://www.coingecko.com/

Step 2: Set up a non-custodial crypto wallet that can hold SOL

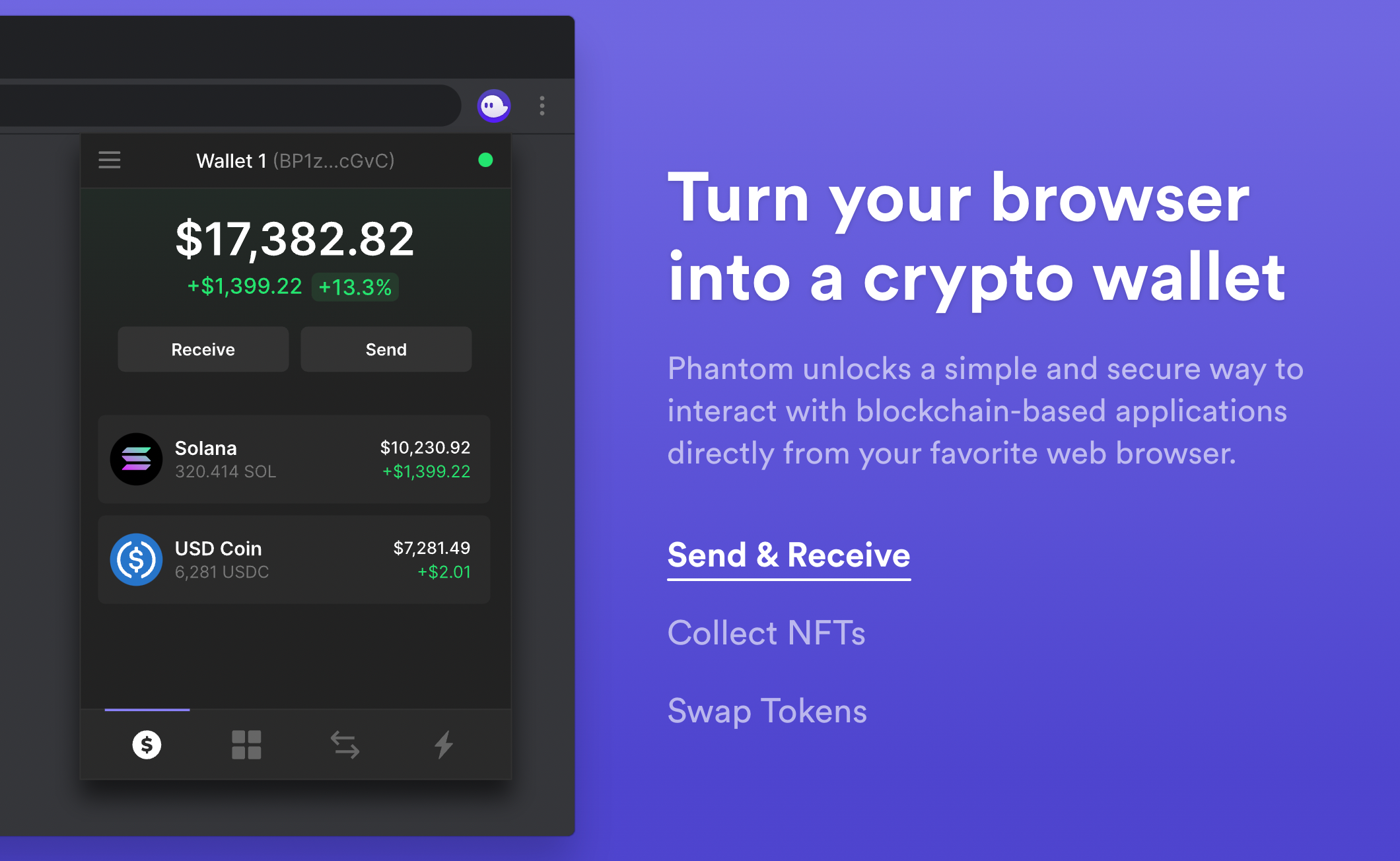

This is where it gets kind of interesting if you haven’t done this before. The #1 recommended wallet to install for the Solana blockchain is called Phantom. Before you install this, I suggest setting up a separate browser profile on your computer for your crypto stuff, because you will be giving the crypto wallet (necessarily) broad permissions.

Download & install the Phantom wallet here: https://phantom.app/ (They now have a very nice iOS mobile app!)

SUPER IMPORTANT: During the set up process, you will be given a list of words. This is the master key to your wallet. NEVER GIVE THESE WORDS OUT TO ANYBODY, FOR ANY REASON. Only scammers will ask you for them. If you do, they can take anything that is inside the wallet. Store them safely somewhere. If you need to re-install the wallet, (new computer, different browser, the mobile app comes out, etc), you WILL NEED these words in the specific order to access your stuff. So don’t lose them. And don’t give them to anybody.

Once you’ve set up your Phantom wallet, you now have a “wallet address.” This is a long string of numbers and letters that identifies your stuff. It can receive funds and NFTs, (and importantly, also display them, which is nice). You will use the wallet to interact with Distributed APPS (DAPPS) that will typically have a Wallet button in the (usually) top right corner of the screen. When you click that button, it will trigger a request to your wallet to ask for permission to see what’s inside. This is generally a safe permission to give, assuming you feel the underlying site is legitimate.

You’ll find the wallet icon in your browser’s Extensions area, and you can “pin” it to the top right of the browser UI if you’d like quick access to it.

Step 3: Send some SOL to your Phantom wallet.

Here is where again it gets interesting. On your centralized exchange account, once you’ve purchased some SOL, you can now Send it somewhere. You are now going to copy your Phantom Wallet address, and paste it into your exchange where it says “Send to address” or something like that. You will then confirm you want to send the funds. You may have to confirm with 2-factor authentication if you’ve set that up (recommended).

This will transfer the funds from your custodial (central exchange) wallet to your Phantom wallet. You should see the funds show up very quickly there after you confirm the send.

Now you have some SOL in your Phantom wallet, and you can now start to play around in the Solana blockchain ecosystem.

Step 4: Figure out what you want to do next.

There are many things you might find interesting on the Solana blockchain. Because it is fast, and very inexpensive to conduct transactions, there are lots of people building projects that are worth a look. Also a very active NFT community.

NFTs on Solana

Mint a NFT or purchase one on the secondary market

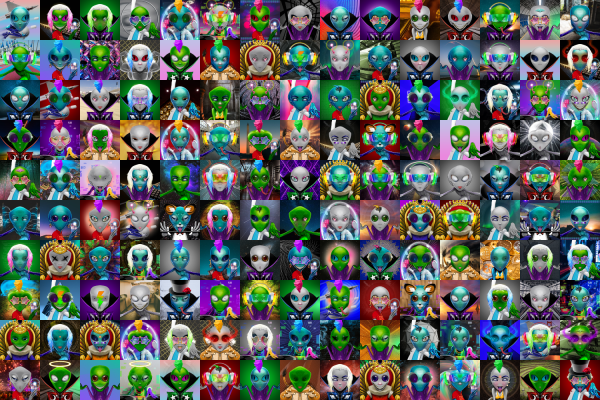

What are NFTs exactly? Basically they are a way to assign ownership of an asset from one party to another, using the blockchain to record publicly that this has happened. There are lots of NFT projects out there, many art focused ones (like what Sol Visitors is all about), including MANY personal profile picture projects (also called PFPs), and almost every project out there is trying to create a sense of useful community for people interested in collecting the art, or flippers who want to buy low and sell high.

Some of these NFT projects have gone crazy in terms of the cost to buy one, because they are a scarce resource, and if the project is worth joining, and you need one of their NFTs to participate, some people are willing to pay extremely ridiculous prices for this.

Each NFT project will typically have its own website promoting the art, the community, and the roadmap, also usually a Twitter account (used for public communications, give-aways, and general awareness building), and a Discord server where people who are interested can gather, chat, share ideas, and generally nerd out together.

I’ll recommend our project’s links if you’re curious to get started:

Website: https://solvisitors.com/

Twitter: https://twitter.com/SolVisitors

Discord server: https://discord.gg/TF7zW5q9Ur

Instagram: https://www.instagram.com/solvisitors/

For any of the platforms that offer participation, it’s very helpful for you to follow the account, and then like & retweet / share anything that catches your attention. We certainly appreciate it!

Secondary market for NFTs on Solana

There are numerous secondary markets where you can buy and sell NFTs on Solana. All require you to have a wallet in order to participate. Getting projects “Verified” on these platforms involves some work, but then gives a way for both buyers and sellers to have confidence that what it looks like they’re buying is actually the genuine article.

- Magic Eden – https://magiceden.io/

- Alpha.art – https://alpha.art/

- Solanart – https://solanart.io/

- Solsea – https://solsea.io/

- DigitalEyes – https://digitaleyes.market/

Sites to check how rare your NFT is, other NFT data

When a NFT series has a lot of pieces (it’s common to offer a series of 10,000 individual, unique pieces, for example), pricing is often influenced by how rare a piece is. There are a number of sites that provide helpful rankings and information about any given collection they’ve indexed. Not all collections get indexed.

- HowRare.is – https://howrare.is/

- MoonRank – https://moonrank.app/

- Solanalysis – https://solanalysis.com/

- RadRugs Security Leaderboard – https://rankings.radrugs.io/

- View your NFTs on a web page: https://nfteyez.global/

Upcoming NFT Project Release Dates

There are a lot of these calendars now available, if you’d like to research upcoming NFT mint websites, the date of mint, cost, number of pieces, links to websites, Twitter and Discord communities.

- Solanalysis Upcoming NFT Drops – https://www.solanalysis.com/upcoming?filterType=upcoming

- NFT Calendar – https://nftcalendar.io/b/solana/

- NFT SOL Calendar – https://nftsolana.io/

- HowRare.is Drops – https://howrare.is/drops

- NFT Evening – https://nftevening.com/calendar/?event-blockchain=1417

- KupiCrypto – https://www.kupicrypto.com/

- NFT Desire – https://nftdesire.io/upcoming-nft-projects/

- Upcoming NFT – https://upcomingnft.art/

- Non-Fungi Solana NFT Drops – https://www.non-fungi.com/solana-nft-drops/

- KannaKrew NFT Drop Calendar – https://kannakrew.com/cal-nft/

Decentralized Finance (DeFi)

Exchange some SOL for other crypto coins on a Distributed Exchange (DEX).

Recommended DEX: Orca.so

So now you have some SOL, and maybe you want to exchange it for another kind of cryptocurrency (maybe one not available on your central exchange, like $SAMO or $CATO for example). A very nicely designed and beginner-friendly DEX that I like is called Orca.so. Here you will connect with your wallet, and now you can very easily and quickly exchange SOL for many other types of coins. What are these coins useful for? A lot of them are basically speculation plays, you’re betting that if you buy them (low) you can then sell them (high) and make a profit. Some people get emotionally invested into a coin and its community, and will hold it for the long term, believing that it will eventually go way higher.

It is possible to make quite a bit of money speculating on crypto coins. It is also very possible, perhaps even more likely, that you may LOSE quite a bit of money doing the same thing. My suggestion is to start small, and if you make some profits, take them off the table so you’re now playing with house money, which if it goes to zero, you won’t be too sad about.

Experiment further with Decentralized Finance (DeFi)

Recommended for Basic yield farming: Orca.so

Besides exchanging one cryptocurrency for another, you can also get into Lending your crypto, Borrowing crypto, and doing what is called Yield Farming. Orca offers basic Yield Farming, where you can get some crazy high APYs on your money, but in my experience, the volatility of the underlying cryptos far outweighs the offered rewards for doing so. So you still need to watch the overall markets, keep an eye on things.

The underlying principle of yield farming is that an exchange (like Orca) needs Liquidity in order to allow exchanges from one cryptocurrency to another. This Liquidity is provided by people like you and me, by depositing pairs of coins. The idea is you deposit some amount of one coin, and a second one, and then Orca can use that to help people exchange money. You get a reward for lending your currency to them for this purpose. Orca also has “Double-Dip” pools, where you get a second reward on top of your main one. This is how the APYs can be so high – crypto coin projects will offer a bunch of coins to people just to have in exchange for participating in the liquidity provision (basically it’s a marketing expense for them).

There are a bunch of possible risks with Yield Farming, including Impermanent Loss, possible bugs in the smart contract (“smart contract risk”), the DEX being hacked and funds drained, etc. Here’s a good explainer on these risks.

LEVERAGED YIELD FARMING WITH AUTO-COMPOUNDING – !!!DANGER!!! – ALSO CAN BE FUN

Not necessarily a recommendation, but it’s what I use: Francium.io also Tulip.garden

So what happens when you take Basic Yield Farming, and then decide to borrow funds in order to “work with more money”? There are a number of platforms that enable exactly this, up to a 3x leveraged position, plus the benefit of auto-compounding. This means if you deposit $100 USDC for example, you’ll be borrowing up to $200 from other folks, paying hefty interest on it, but can still make a lot of money, depending on the price movement of the underlying currencies, and 3x your returns. YOU CAN ALSO 3x YOUR LOSSES. All leveraged Yield Farming platforms include something called Liquidation. This is an automatic process whereby if your borrowing collateral gets too low as a total percentage of the position, they will liquidate your position and return the borrowed funds to the lenders. This protects lenders from losing their funds, but can cost a LOT to you as the borrower if it happens (it happened to me once, and I did not like it.)

Lending your Crypto to make money, earn 20, 30, 90%+ on it!

I use these for lending crypto on Solana: Francium.io, Tulip.garden

On both of those same platforms, you can also lend your crypto to earn interest from people borrowing it. The rates are generally quite high compared to any traditional bank account, and in my view, this is a generally very safe way to earn some money while holding crypto. It can be a good strategy to lend some out as a way of just holding on to it as a reserve (“savings account”) and then play with some of the leveraged yield farming if you have a taste for that with a portion of what’s left.

I suggest getting comfortable by doing a small test transaction (this all happens through a combination of what the site is offering, and by having your wallet connected, and then approving transactions inside your wallet).

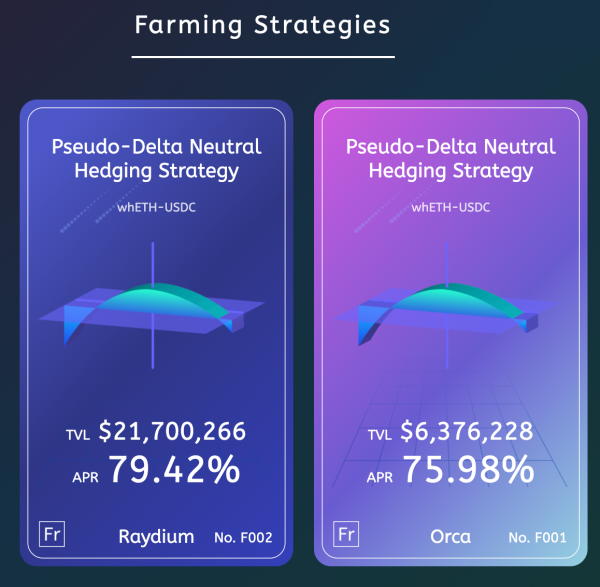

Francium.io just launched an interesting thing which is called a “Pseudo-Delta Neutral Hedging Strategy” where you deposit funds, and they take out both a long and a short position on a coin pair, meaning you can somewhat reliably just collect the rewards, and it doesn’t matter as much whether it goes up or goes down. I have some funds in this, and it seems like a good way to be able to sleep at night.